Living in a residential strata property means shared spaces and, sometimes, shared risks. Whether it’s minor damage like graffiti, or something more serious like a fire or flood, it’s important to know you’re supported.

Our experienced claims team offers clear advice and practical tips to help you and your community get the best possible outcome. If something major happens, we’ll work closely with your strata manager to minimise disruption and keep things moving. Here’s how you can help the process run smoothly.

Step 1 | Make safe repairs

If your property is damaged, safety comes first. Always contact your strata manager as your first point of call – they can help coordinate any necessary repairs. In urgent situations where your strata manager can’t be reached (such as after hours), you can contact one of the recommended emergency repairers listed below. Be sure to keep any reports or invoices, as the insurer will need to review them to confirm what’s covered.

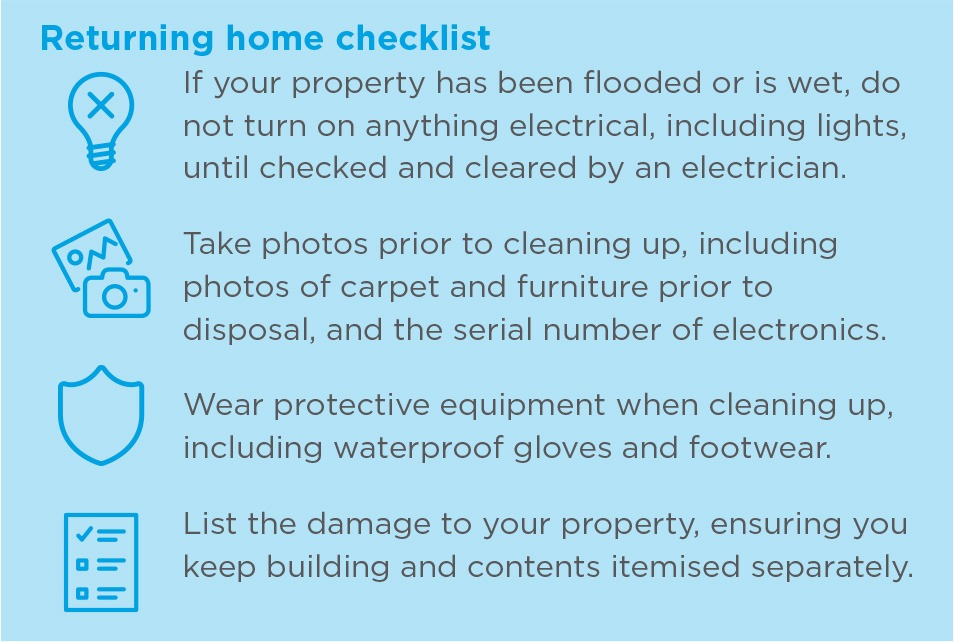

Step 2 | Returning home checklist

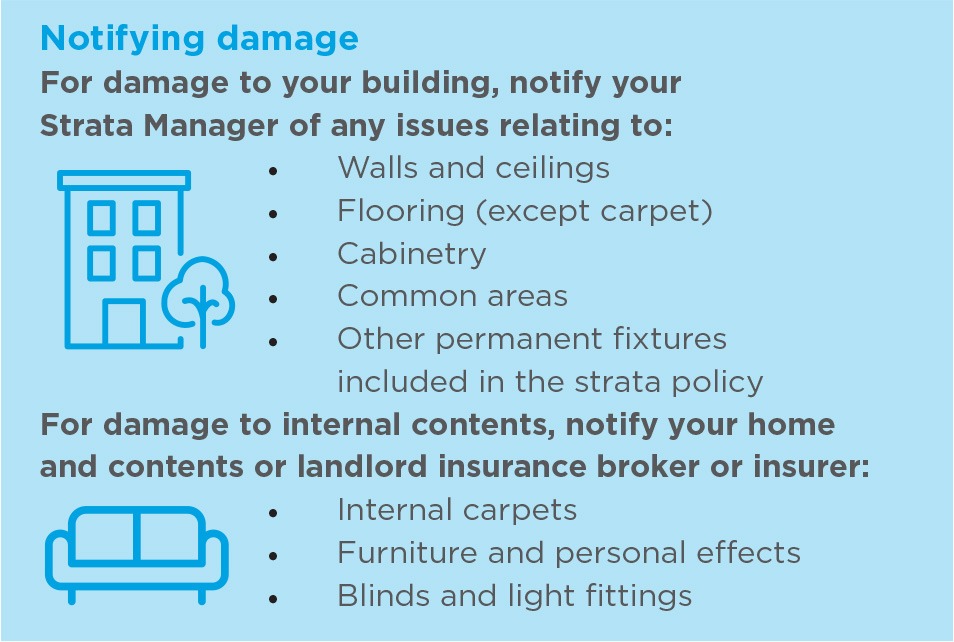

Once it’s safe to return to your property, inspect your unit and belongings for any damage. Use the Returning Home Checklist below to guide you. Report any issues to your strata manager, and if you hold contents insurance, remember to notify your contents insurer if necessary.

Step 3 | Lodging an insurance claim

Your strata manager will handle building-related claims on your behalf. To assist with that process, they will need to provide the following details to us:

- Owners Corporation (OC) or Strata Plan number

- Units affected, along with relevant contact details of those who need to be contacted regarding the claim and repairs

- Date of loss

- Details of the damage and whether you require your insurer to appoint an assessor and/or repairer

- Quotes and invoices (if available)

Contact details for emergency contacts, insurers and insurer service providers

Emergency contacts

- 000 Police, Fire, Ambulance, for life-threatening emergencies

- 132 500 SES Storm and flood assistance

- 106 TTY Text Emergency Relay Service, if you have a hearing or speech impairment

Insurers

- CHU 1300 361 263 business hours or 1800 022 444 after hours

- Flex 1300 361 263 business hours or 1800 022 444 after hours

- Axis 03 8660 7066 business hours or 03 8660 7000 after hours

- SCI 1300 724 678

- SUU 1300 668 066

- Hutch 1300 900 216

- Longitude 1300 442 676

Service providers

CHU and Flex

Panel repairers

- ADB Constructions 07 5620 0465

- Advanced Buildings 1300 878 687

- Ambrose Constructions 1300 228 761

- BMR Building Solutions 1300 276 247

Restorers

- PHJ Services 07 5520 7733

- Qrestore 07 5593 4968

- Beyond Clean 07 3071 0035

- Westaway Restorations 07 5598 3292

Axis

Builders & restorers

- North Star Builders 1300 504 668

- Johns Lyng Group 1300 218 992

- Construct Services 1300 266 787

SCI

Panel repairers

- Prime Buildings 07 3554 3704

- ADB Constructions 07 5620 0465

- Australian Restoration & Constructions 1300 728 225

- Restorers Pircsa 07 3267 7068

- Beyond Clean 07 3071 0035

SUU

Builders & restorers

- Advanced Building Services 1300 878 687

- John Lyng Group 1300 945 945

- Rizon Builders 1300 474 966

Hutch

Builders & restorers

- Bentino Builders 1300 284 537

- Ezy Projects 1300 399 776

- Nexus 1300 321 416

- Insurer Build 1300 722 272

- Restore Corp Brisbane metro only 1300 591 459

Longitude

Builders & restorers

- Advanced Builder 1300 878 687

- Nexus 1300 321 416

- North Star Builders 1300 504 668

- Rizon Builders 1300 474 966

Need help? We’re here to support you

If you have questions about the claims process or need help with a specific issue, please contact your strata manager in the first instance. They’ll coordinate with our team where required.

For general insurance enquiries or to speak with a Whitbread broker or claims consultant, call us on 1300 424 627. We’ll work with you to confirm next steps, keep things moving and ensure the best possible outcome for your community.

Useful links and resources

Whether you’re new to strata living or have been part of your community for years, these resources offer extra support when you need it.

- Claims assistance www.whitbread.com.au/claims/

- Insurance insights and updates www.whitbread.com.au/the-whitbread-channel/

- Contact us www.whitbread.com.au/contact/

Download a PDF of our article here

T: 1300 424 627

E: info@whitbread.com.au

Important notice

This article provides information rather than financial product or other advice. The content of this article, including any information contained in it, has been prepared without taking into account your objectives, financial situation or needs. You should consider the appropriateness of the information, taking these matters into account, before you act on any information. In particular, you should review the product disclosure statement for any product that the information relates to it before acquiring the product.

Information is current as at the date the article is written as specified within it but is subject to change. Whitbread Insurance Brokers make no representation as to the accuracy or completeness of the information. Various third parties have contributed to the production of this content. All information is subject to copyright and may not be reproduced without the prior written consent of Whitbread Insurance Broker.

This article is not intended to be personal advice and you should not rely on it as a substitute for any form of personal advice. Please contact Whitbread Associates Pty Ltd ABN 69 005 490 228, License Number 229092 trading as Whitbread Insurance Brokers for further information or refer to our website.