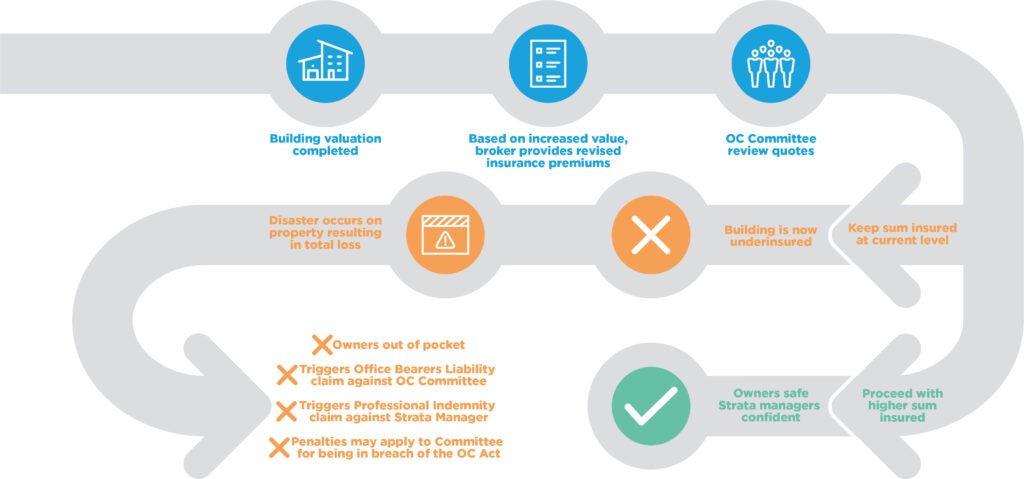

You’ve sought professional advice and obtained a valuation. Now the question is, do you take it or leave it? When it comes to determining a Building Sum Insured, disregarding professional advice could be detrimental to everyone concerned: The property owner, the Owners Corporation (OC) Committee and you, the Strata Manager.

One responsibility of an OC Committee is to ensure the property is insured for full replacement and reinstatement value. A professional property valuer can determine this for the OC Committee. Unfortunately, OC Committees don’t always follow the recommendations provided…

Example of consequences

Recently, after receiving an updated valuation from a Strata Manager, Whitbread proceeded to arrange renewal terms and comparative quotes based on the higher sum insured, in accordance with the valuation.

The property, consisting of 22 residential units, had a current Building Sum Insured of $2,500,000 and the valuation recommended the building replacement cost should be $5,850,000 – a substantial difference.

When the Strata Manager presented the renewal terms – in accordance with the valuation – the OC Committee voted not to increase the sum insured.

Whitbread were advised of the OC Committee’s decision, however it would have been a breach of our professional duty for us to action the request. Doing so could have led to legal exposures for all involved.

Exposures to the OC Committee

According to the Owners Corporation Act 2006, Sect 59 – Reinstatement and Replacement Insurance, pages 31 to 32, legislation requires that a building is insured for full replacement and reinstatement value. Providing instructions to underinsure the property may expose the OC Committee to and Office Bearers Liability claim.

Exposures to the Property / Lot Owner

If the property is underinsured, in the event the building is a total loss, the property owners would be responsible for additional costs in excess of the policy limit. To put this into context, using the earlier example, if this building was subject to a total cost each of the lot owners could be almost $153,000 out of pocket.

Exposures to the Strata Manager

Any company or individual providing professional advice or services can be held liable for financial loss arising from errors or omissions committed as part of their professional services. In our example, the Strata Manager could be exposing themselves to a Professional Indemnity claim if the OC incurred a financial loss that could be attributed to a breach of professional duty.

What to do when you have a valuation

Once a valuation has been obtained, it is the responsibility of the strata committee and Strata Manager to review the findings and ensure they are properly considered when arranging insurance. This includes checking that the valuation reflects the correct scope of cover under the relevant state legislation (such as total replacement value including demolition, professional fees, and GST), and ensuring that the sum insured on the insurance policy aligns with the valuation figure.

Importantly, the Owners Corporation should provide the valuation to their insurance broker as soon as possible to ensure the updated figure can be factored into the renewal or current cover without delay. The committee should formally minute any decisions made regarding the use or disregard of the valuation, and retain documentation to support their reasoning, especially if they choose to insure for a different amount. Transparent communication with all lot owners about how the valuation has informed the insurance cover is also recommended, as this promotes accountability and helps mitigate potential disputes or claims of negligence.

The power of a building valuation

How Whitbread supports compliance and protects stakeholders

As an insurance broker, Whitbread have a duty under The Insurance Brokers Code of Practice to abide by the law, which means that arranging insurance for an amount less than specified in the Owners Corporation Act is a breach of our duty as an insurance broker. Accordingly, Whitbread will always recommend a building is insured in accordance with the most current valuation.

Achieving the best Strata Insurance outcome

Whitbread recommend that Strata Managers advise their clients to obtain a professional property valuation by a Sworn Valuer every three to five years, ensuring the building remains adequately insured, and adjust insurance coverage accordingly. Please contact your Whitbread insurance broker if you would like to know more about the valuations or to discuss a particular risk in greater detail.

Download a PDF of our article here

T: 1300 424 627

E: info@whitbread.com.au

Important notice

This article provides information rather than financial product or other advice. The content of this article, including any information contained in it, has been prepared without taking into account your objectives, financial situation or needs. You should consider the appropriateness of the information, taking these matters into account, before you act on any information. In particular, you should review the product disclosure statement for any product that the information relates to it before acquiring the product.

Information is current as at the date the article is written as specified within it but is subject to change. Whitbread Insurance Brokers make no representation as to the accuracy or completeness of the information. Various third parties have contributed to the production of this content. All information is subject to copyright and may not be reproduced without the prior written consent of Whitbread Insurance Broker.

This article is not intended to be personal advice and you should not rely on it as a substitute for any form of personal advice. Please contact Whitbread Associates Pty Ltd ABN 69 005 490 228 | AFSL 229 092 trading as Whitbread Insurance Brokers for further information or refer to our website.